Nifty closed the day at 5304.45 down by 70.20 points. Nifty April future closed at 5293, discount of 11.45 points.

- FII bought in Cash (Net buy 62.20 Crore)

- FII bought in index options, but sold in index futures and stock futures (Net sold 302.32 Crore)

- DII sold in Cash (Net sell 93.62 Crore)

- US market ended just Flat to Negative.

- Global cues are flat to Negative.

- SGX nifty is Flat as of now.

- Most Active April Nifty Call Option: 5400 and 5300.

- Most Active March Nifty Put Options: 5200 and 5300.

- Put Call ratio stands at 1.23

- Advance Decline for the day was 441:854

As anticipated about the implication of “Doji”, market reacted exactly in same manner and closed below important support level of 5310. Nifty daily chart has formed “Long Black Candle” a bearish candlestick pattern after two consecutive doji days. Daily momentum indicators have given negative crossover to signal line after experiencing over bought zone in previous days. Over all scenario turned weak as long as nifty is trading below 5345 level.

NIFTY Technical

Current Spot: 5304.45

Pivot: 5322

3DEMA: 5332

7DEMA: 5320

20DEMA: 5242

RSI (7 days): 54.72

Supports: 5273 - 5241

Resistance: 5353 - 5402

Target Nifty

Buy Nifty above 5325 - 5348 - 5398 - 5428 SL - 5318

Sell Nifty below 5294 - 5274 - 5243 - 5194 SL - 5323

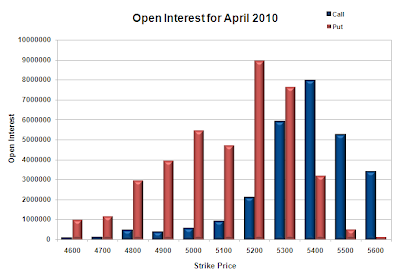

Option Open Interest

Yesterday there was a huge Open Interest buildup in 5300 and 5400CE and 5200PE April Strike price indicating that Option writers are playing for 5250 - 5350 range for time being.

Option & Futures Call

Buy Nifty 5300PE above 88.3 for targets of 104, 120 SL - 77.9

Buy Nifty 5400CE above 48.2 for targets of 55.8, 68.7 SL - 42.1

Swing Trade

Voltas (182.30)

Yesterday Stock has broken mid January downward slopping trend line with strong volume and formed “Long White Candle” a bullish candlestick pattern on daily chart. Daily momentum indicators hovering in bullish zone especially RSI has given positive cut to signal line. Short term moving averages showing upward movement in stock. Looking at all above technical parameters traders with moderate risk appetite can consider Buy above 183.40 with tight stop loss of 180 for a Target of 190.

Stock Ideas for the Day

Reliance Industries: Buy above 1120 for targets of 1125, 1136, 1147 SL of 1112

Reliance Industries: Sell below 1101 for targets of 1096, 1083, 1071 SL of 1118

Vijaya Bank: Buy above 49.20 for targets of 50.2, 51.6 SL of 48.4

Dena Bank: Buy above 80.80 for targets of 82.2, 84.6 SL of 79.2

IFCI: Buy above 53.5 for targets of 54, 55 SL of 52.6

Positional Call

Ballarpur Industries: Buy above 31.6 for target of 34.8 SL of 31.1 (One Month)

Indraprastha Medical: Buy above 48.3 for target of 51 SL of 47.5 (One Week)

Use strict STOP LOSS in each and every trade in this kind of volatile market and Trade at your own risk.

Thanks and Regards

S&P Wealth Creators

Call 09831497250 or mail us @ S&P Wealth Creators with your Name and Mobile No. for subscription offer of intraday calls during Market hours.

0 comments:

Post a Comment

Please leave your comments here...